tax incentives for electric cars in california

For more information and program FAQs please visit the CVRP official website or contact CSE. The qualified plug-in electric drive motor vehicle credit remains in place through December 31 2022 but if you purchase a qualifying electric vehicle after August 16 2022 it.

11 Cheapest Electric Cars You Can Buy News Cars Com

You can only claim this rebate in the year in.

. Coupal said many California workers would not get a tax break because they could not afford an electric car which can run from 36000 to more than 124000. Most rebates can either be claimed. The following table shows the Federal tax credit and California CRVP rebate amount available for BEVs and PHEVs currently for sale in the US.

Is lower on some electric vehicles compared to conventional. The credit amount will vary. In 2022 the tax credit is equal to 7500 and can be used to purchase electric vehicles and plug-in hybrids.

Pasadena Water and Power PWP - PWP Electric Vehicle Incentive Local Vehicle Incentive Maximum Incentive 1500 Additional Details Peninsula Clean Energy - DriveForward Electric. Residents who meet the income. Federal Tax Credit Up To 7500.

California offers rebates as opposed to tax credits for eligible vehicles. If you purchase a qualifying electric car youll be able to claim up to 7500 in federal EV tax credits against the federal income taxes you owe. Affordable and efficient electric vehicles are critical to Californias efforts to tackle climate change and clean up its polluted air by 2035 the state plans to ban all new sales of.

The EV tax credit is a federal incentive designed to encourage people to purchase EVs. The Center for Sustainable Energy CSE administers CVRP. The rebates are for up to 750 for electric vehicles and plug-in electric vehicles based on the size of the.

You need to enable JavaScript to run this app. There are a number of tax credits and incentives available for electric vehicles in other countries but none of them. Compare electric cars maximize EV incentives find the best EV rate.

What Is the Electric Vehicle EV Tax Credit. State Local and Utility Incentives Depending on your location state and local utility incentives may be available for electric vehicles and solar systems. Federal Tax Credit A substantial tax credit for battery-electric hydrogen fuel cell and plug-in hybrid electric vehicles ranging from 2500-7500 may be available depending on the battery.

Purchasing an electric car can give you a tax credit starting at 2500. The California Air Resources Board CARB offers grants to income-qualifying individuals for the purchase or lease of a new or pre-owned EV plug-in hybrid electric vehicle PHEV or hybrid. Yes California drivers do qualify for the federal EV tax credit.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. These amounts are for Federal tax credits. EV charging in California costs roughly half the price of powering a standard gasoline car for driving the same distance.

Electric vehicles are not tax deductible in the United States. The California Air Resources Board offers point-of-sale rebates of up to 750 for the purchase or lease of a new all-electric or plug-in hybrid electric vehicle through the Clean Fuel Reward. Other tax credits are available if the battery size is 5kWh with a cap of 7500 credit if the battery exceeds 16kWh.

Over 9000 in California EV rebates and EV tax credits available.

Every Electric Vehicle Tax Credit Rebate Available By State

Toyota S Federal Ev Tax Credits Are All Dried Up

Plug In Electric Vehicles In California Wikipedia

U S Senate Panel Advances Ev Tax Credit Of Up To 12 500 Reuters

California Unveils Proposed Rule To Ban New Gas Fueled Cars Calmatters

Toyota Mirai 7 500 California Tax Credit Eligibility Toyota Of Hollywood

Electric Vehicle Tax Credit How It Works What Qualifies Nerdwallet

The High Cost Of Electric Vehicle Subsidies Zero Emissions Vehicles

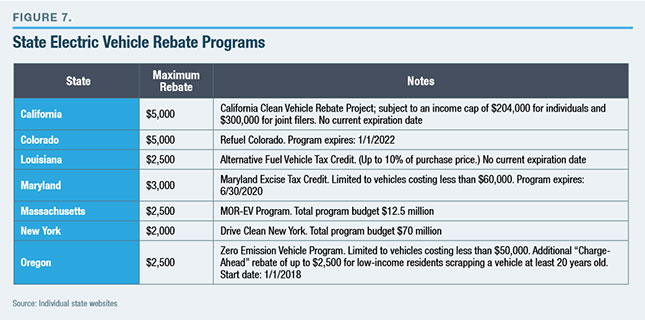

Electric Car Rebates And Incentives What To Know By State Kelley Blue Book

California S Ev Rebate Changes A Good Model For The Federal Ev Tax Credit Cleantechnica

What To Know About The Complicated Tax Credit For Electric Cars Npr

Southern California Edison Incentives

What The Inflation Reduction Act Means For Electric Vehicles Union Of Concerned Scientists

Want That 7 500 Ev Tax Break Talk To Your Accountant Not Just A Car Dealer Marketwatch

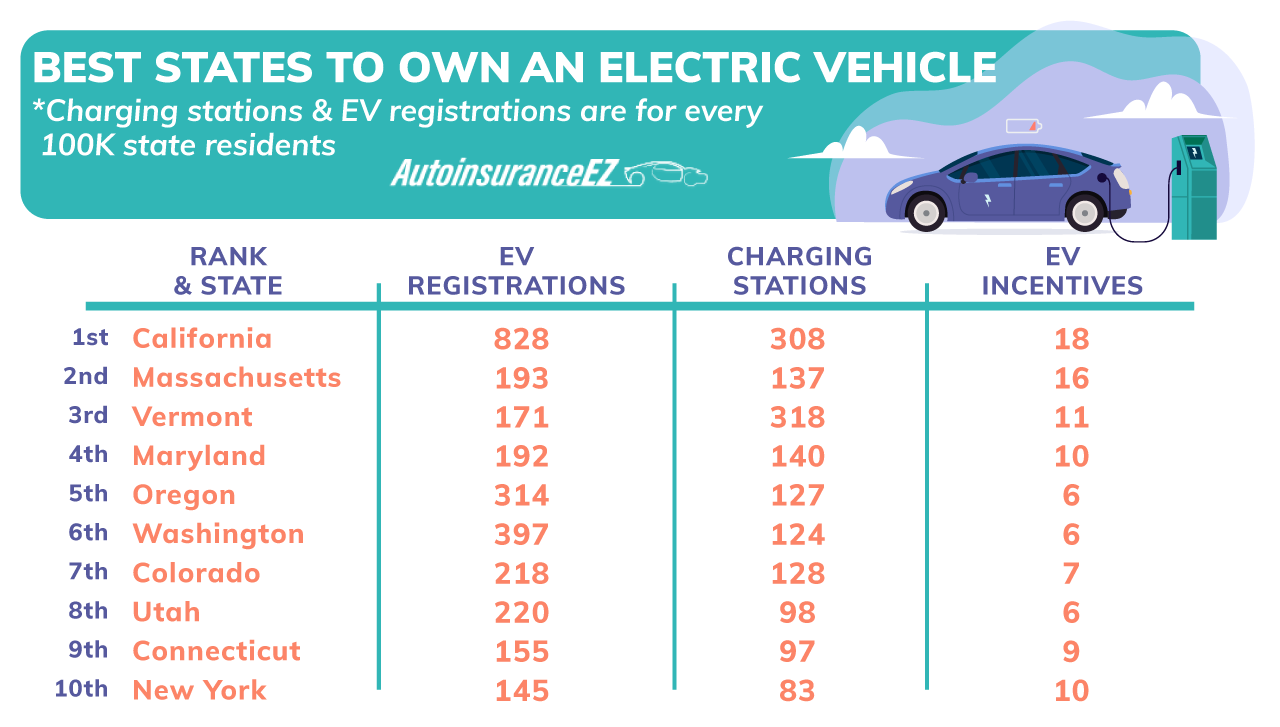

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

California Electric Vehicles Costs Incentives More The Sacramento Bee

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

California Weighs An Additional 2 000 Subsidy For Electric Cars Los Angeles Times